KUALA LUMPUR, Feb 7 – Malaysia risks losing access to innovative drugs if prescription medicine prices are regulated, according to a cost-benefit analysis published by the Malaysia Productivity Corporation (MPC).

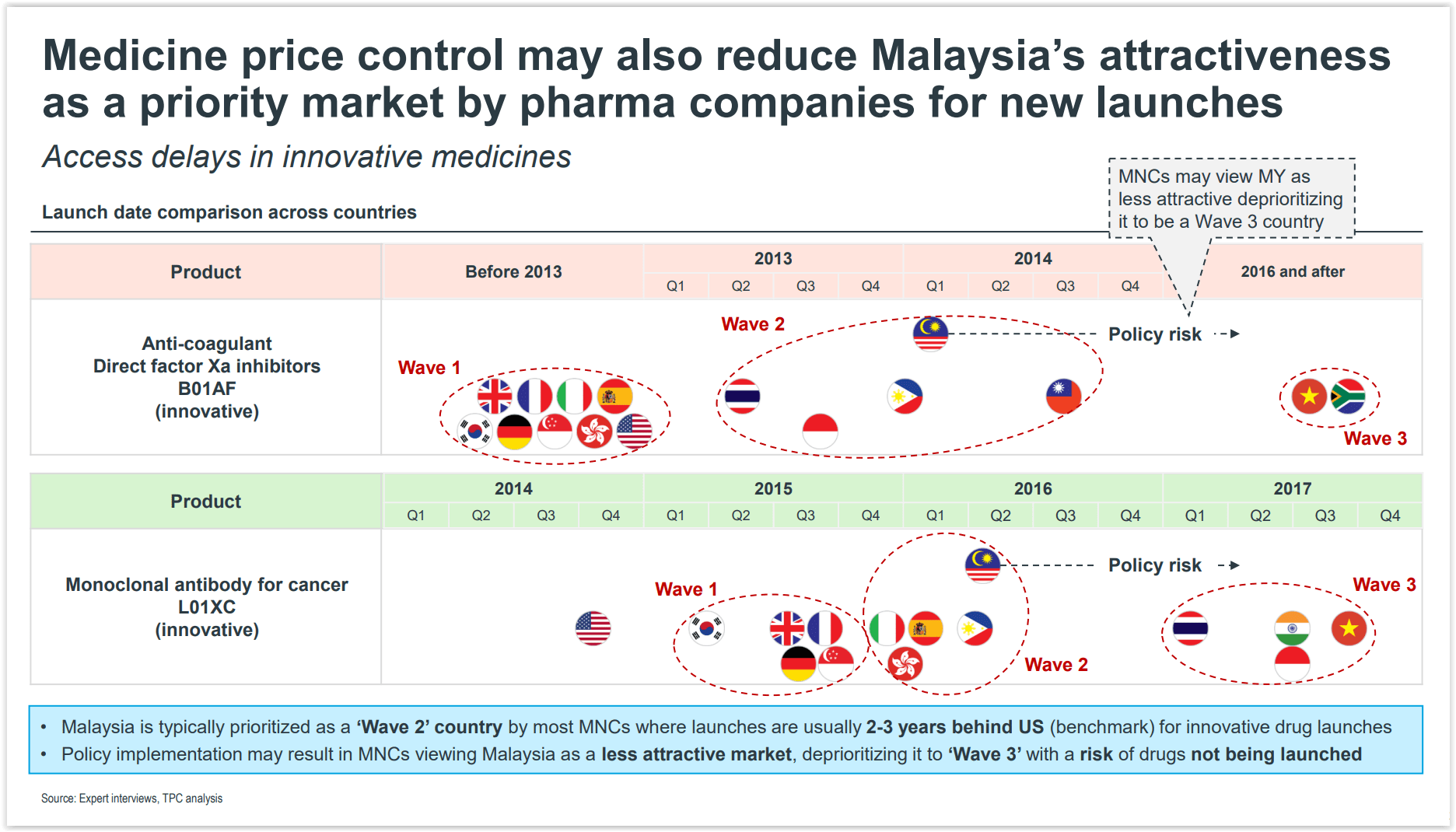

The study pointed out that Malaysia is typically prioritised as a “Wave 2” country by most pharmaceutical multinational corporations (MNCs), where innovative drug launches are usually two to three years behind the United States.

This can be seen in the launch of the anticoagulant direct factor Xa (FXa) inhibitors B01AF – a type of medication that is used to treat blood clots in the blood vessel and prevent stroke in people with nonvalvular atrial fibrillation or a person with an irregular heart rhythm.

The innovative oral anticoagulant drug can decrease stroke recurrence by 20 per cent and extend the quality of life in stroke patients by 6 per cent.

The anticoagulant FXa inhibitor B01AF was launched in “Wave 1” countries such as the US, the United Kingdom, Germany, South Korea, and Singapore before the year 2013.

In “Wave 2” countries like Thailand, Indonesia, Malaysia, the Philippines, and Taiwan, access to the drug only took place between 2013 and 2014. The drug was launched in Malaysia in the first quarter of 2014 (1Q14).

“Wave 3” countries like South Africa and Vietnam received the drug much later from 2016 onwards.

In the case of the monoclonal antibody for cancer L01XC – an immunotherapy treatment used for several cancers, including lung cancer which has a poor prognosis and survival rate – the treatment was launched in “Wave 1” countries in 2015.

Some “Wave 2” countries were given access to the treatment between 4Q15 and 1Q16. Malaysia had access to the treatment in April 2016. The immunotherapy treatment can delay progression in lung cancer patients by about 50 per cent.

According to the cost-benefit analysis, the implementation of drug price controls could prompt MNCs to view Malaysia as less attractive, hence deprioritising the county to be a “Wave 3” country, which puts the country at risk of not having direct access to a novel drug at all.

The Comprehensive Cost-Benefit Assessment (CBA 2.0) on the medicine pricing policy conducted with private industry groups from November 29 to December 6 last year is the second cost-benefit analysis of proposed drug price controls.

It covers about 5,000 products, expanding the product scope beyond the first cost-benefit analysis, with MPC describing this latest review as a “more holistic impact assessment” of proposed drug price controls through “data-driven insights”.

This is the fifth and final part in a series of stories on the “Comprehensive Cost-Benefit Assessment on the Medicine Pricing Policy (Preliminary Findings)” document by the Malaysia Productivity Corporation on its public consultation from November 29 to December 6, 2021.

- Part One: Medicine Price Controls May Erase RM206Bil From Economy

- Part Two: Medicine Price Controls: Clinic Closures, RM31Bil Wage Loss In Private Health Care

- Part Three: Medicine Price Controls Benefit Rich The Most, Poor The Least

- Part Four: Drug Price Controls May Slash 60% Of Medical Tourism Revenue