KUALA LUMPUR, Jan 31 – Drug price controls could shut down a third of private clinics in Malaysia and affect up to 136,000 jobs in the private health care sector in 2037.

According to a cost-benefit analysis on the proposed policy, sighted by CodeBlue, drug policy regulation could see about 33 per cent or 2,600 clinics cease operation, as existing laws on consultation fees mean that clinics rely largely on drug revenue to remain profitable.

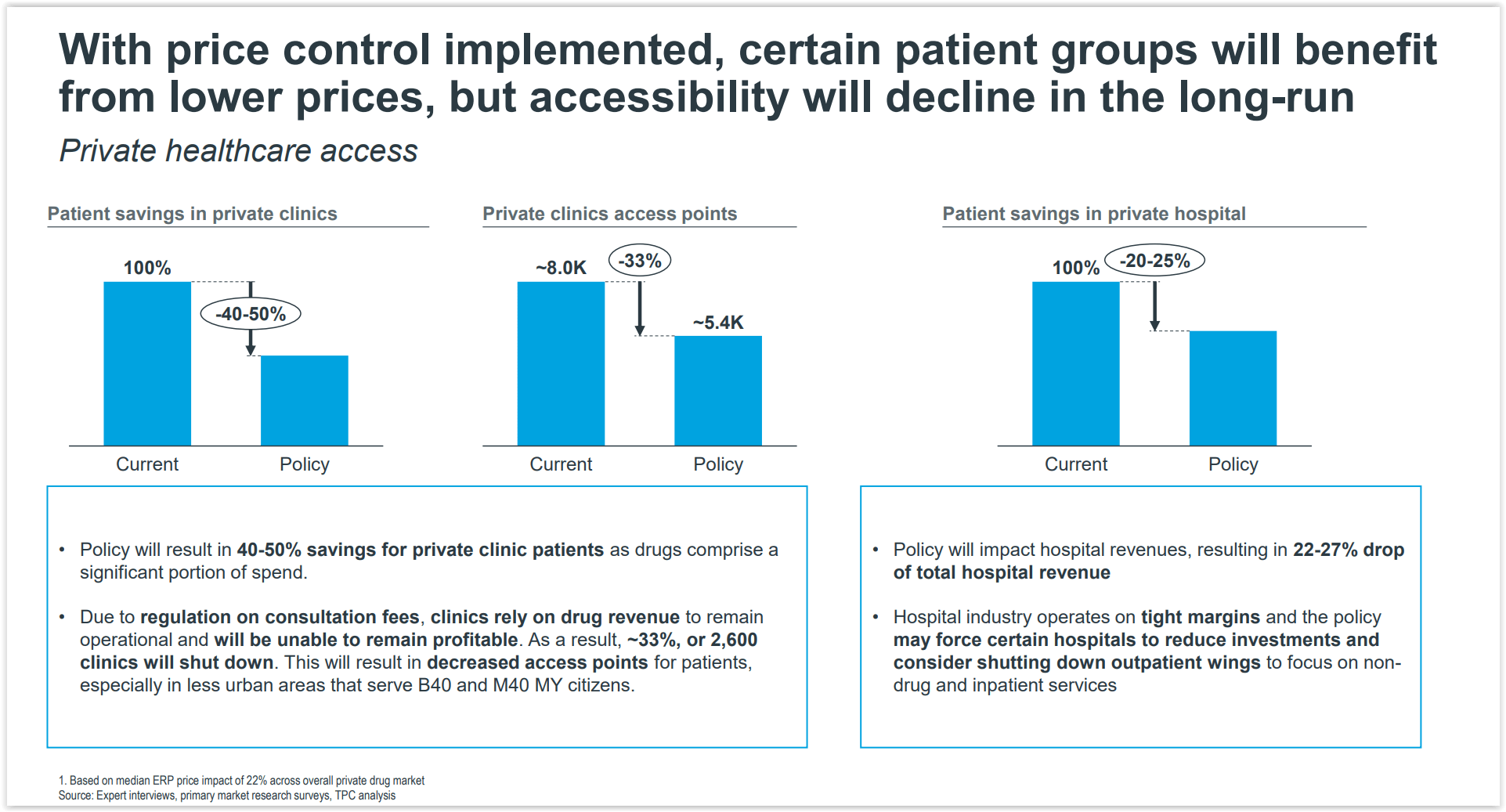

Medicine price caps are expected to result in savings of between 40 per cent and 50 per cent for private clinic patients, as drugs comprise a significant portion of their spending, based on the “Comprehensive Cost-Benefit Assessment on the Medicine Pricing Policy (Preliminary Findings)” public consultation document by the Malaysia Productivity Corporation (MPC) that was released after a consultation with private industry groups from November 29 to December 6 last year.

Consultation fees at private general practitioner (GP) and dental clinics are currently capped at RM10 to RM35, and RM25 to RM250 respectively under Schedule 7 of the Private Healthcare Facilities and Services Act (PHFSA) 1998 (Act 586). Under Schedule 13, private hospital specialists’ consultation fees are legislated at a rate of RM80 to RM235.

Efforts to deregulate private GPs, dentists, and specialists’ professional fees by the Pakatan Harapan administration, 13 years after they were legislated in 2006, failed to materialise following Cabinet’s landmark decision in December 2019 for deregulation.

Private clinic GPs have long demanded that their rates be harmonised with their hospital-based counterparts, whose consultation fees were increased in 2013 to RM30 to RM125.

Another cap on drug prices would hurt their bottom lines even more and force many GP clinics to close for good. This, in turn, will result in decreased health care access points for patients, especially in less urban areas that serve the bottom 40 per cent (B40) and middle 40 per cent (M40) income groups, bringing the number of private clinics down from 8,000 to about 5,400, if the policy is implemented.

The cost-benefit analysis also found that the proposed policy will see a 22 per cent to 27 per cent drop in total hospital revenue, forcing certain hospitals to reduce investment and consider shutting down their outpatient wings to focus on non-drug and inpatient services instead.

Patient savings in private hospitals from medicine price controls are estimated at between 20 per cent and 25 per cent. Major private hospitals in Malaysia are mostly owned by government-linked companies.

The private health care sector is expected to be a socio-economic growth engine for Malaysia and at status quo, it will generate RM1 trillion over the next 15 years from 2022 to 2037.

The sector is also projected to create about 100,000 new jobs, serve 13 million patients annually, and bring in RM44 billion in planned investments in Malaysia over the same period.

It currently employs an estimated 133,000 employees, which is estimated to grow at 9 per cent between 2021 and 2037. Based on the cost-benefit analysis of the drug price control policy, employees in the private health care sector could lose up to RM31 billion in wages, at net present value, across the next 15 years to keep businesses afloat.

It was also noted that medicine price controls in 2037 would put 91,000 to 136,000 jobs (or 30 to 40 per cent of 227,000 employees then) at risk of pay cuts, freeze in salary growth, or layoffs – amounting to an economic loss of about RM4.5 billion to RM6.1 billion that year.

The impact measured by the study excludes downstream impact on industries reliant on the private health care sector such as commercial landlords and building services.

The Comprehensive Cost-Benefit Assessment (CBA 2.0) on the medicine pricing policy is the second cost-benefit analysis of proposed drug price controls. It covers about 5,000 products, expanding the product scope beyond the first cost-benefit analysis, with MPC describing this latest review as a “more holistic impact assessment” of proposed drug price controls through “data-driven insights”.

The Ministry of Health (MOH) wants to regulate medicine prices in the private health care sector by using an external reference pricing mechanism to cap wholesale prices and subsequently set retail ceiling prices of prescription drugs in private hospitals, clinics, and pharmacies, based on regressive markups from the wholesale ceiling price. External reference pricing is determined by comparisons of drug prices in Commonwealth countries, other countries in the region, or those with similar income levels as Malaysia.

MPC served as the lead government coordinating body that coordinated and facilitated the public-private collaboration on the CBA between government agencies, independent economists, and groups representing local and foreign pharmaceutical manufacturers, multinational pharmaceutical companies, private hospitals, and medical doctors.

The CBA 2.0 working group comprises five members from the private health care industry: the Pharmaceutical Association of Malaysia (PhAMA); the Malaysian Organisation of Pharmaceutical Industries (MOPI); the Association of Private Hospitals, Malaysia (APHM); the Malaysian Medical Association (MMA), and the Pharmaceutical Research & Manufacturers of America (PhRMA).

Members of the CBA 2.0 working group among government bodies include the Ministry of International Trade and Industry (MITI), MOH, the Ministry of Finance (MOF), Bank Negara Malaysia (BNM), the Economic Planning Unit (EPU), the Malaysia Healthcare Travel Council (MHTC), the Intellectual Property Corporation of Malaysia (MyIPO), the Department of Statistics Malaysia (DOSM), and MPC.

The cost-benefit analysis was undertaken by an appointed independent global data science company that MPC did not name.

This is the second part in a series of stories on the “Comprehensive Cost-Benefit Assessment on the Medicine Pricing Policy (Preliminary Findings)” document by the Malaysia Productivity Corporation on its public consultation from November 29 to December 6, 2021.