KUALA LUMPUR, Feb 4 – The government’s plan to regulate prescription drug prices is expected to have a negative knock-on effect on medical tourism in Malaysia, a cost-benefit analysis found.

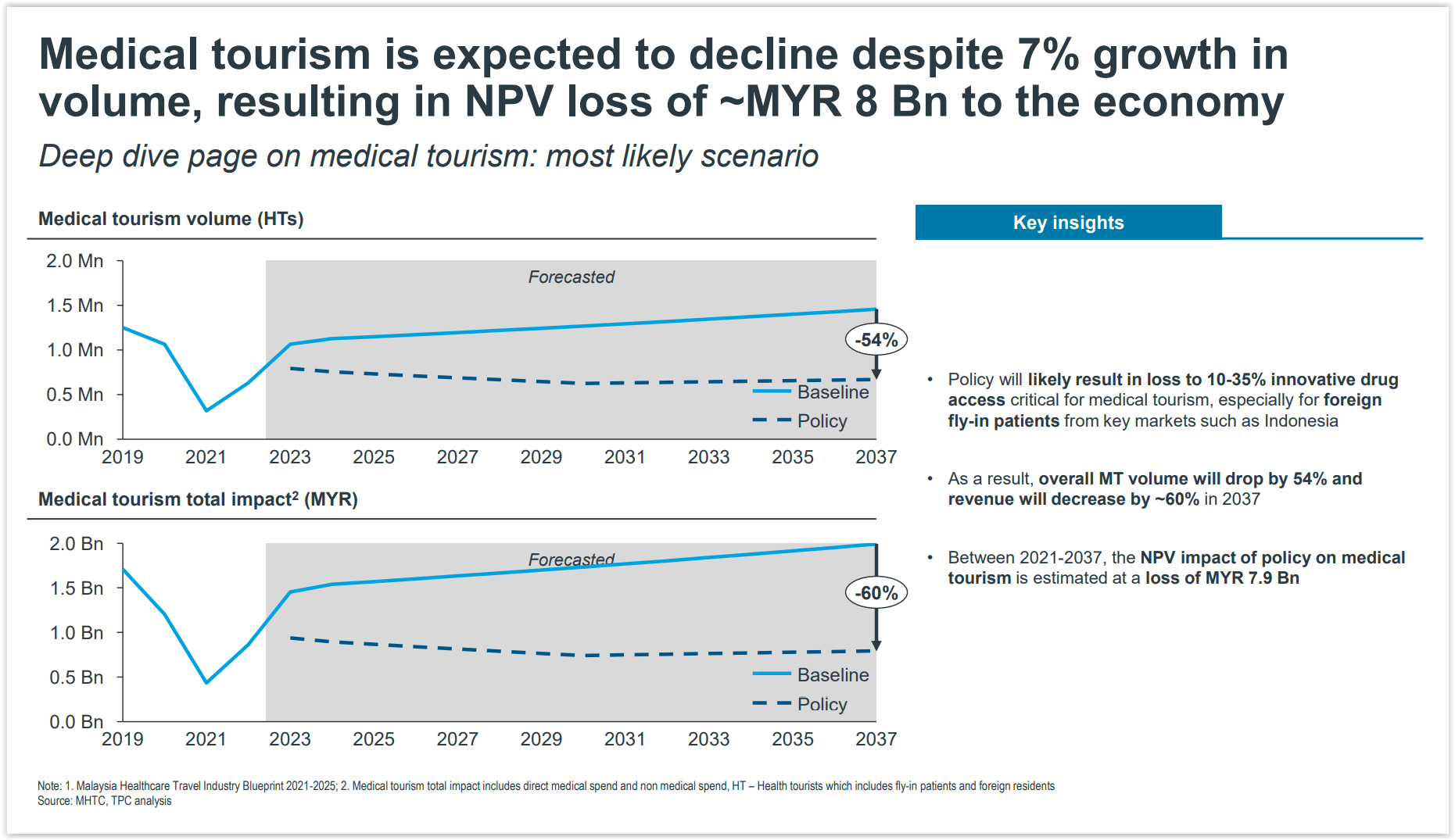

The drug price policy will likely result in a 10 to 35 per cent loss to innovative drug access critical for medical tourism, especially for foreign fly-in patients from key markets such as Indonesia, based on a cost-benefit analysis published by the Malaysia Productivity Corporation (MPC) and sighted by CodeBlue recently.

As a result, Malaysia’s overall medical tourism volume will drop by 54 per cent and revenue will decrease by about 60 per cent in 2037.

Over the next 15 years, the net present value (NPV) impact – a method used to calculate future cash flows generated by an investment – of the drug price control policy on medical tourism is estimated to be a loss of about RM8 billion. This is equivalent to a 30 per cent erosion of the medical tourism sector.

Without the drug price policy, Malaysia’s medical tourism sector is projected to generate RM23 billion to the country’s income over the next 15 years.

The federal government has been attempting to implement price controls on medicines through the Price Control and Anti-Profiteering Act 2011 (Act 723) since the Pakatan Harapan administration, despite opposition from general practitioners (GPs), pharmacists, private hospitals, and both local and multinational pharmaceutical companies.

The plan was to set a wholesale ceiling price that is determined based on the external reference price (ERP), a price comparison with Commonwealth countries, regional countries, and countries with close gross domestic product (GDP) used as benchmarks in negotiations.

However, multiple government changes over the last few years meant the contentious policy remains under review.

The Pharmaceutical Association of Malaysia (PhAMA), which represents multinational pharmaceutical corporations in Malaysia, previously expressed its willingness to declare wholesale medicine prices to MOH so that the government could look at retail prices instead. But the association warned the government that drug price controls could hurt Malaysia’s medical tourism.

PhAMA president Chin Keat Chyuan told The Malaysian Reserve that drug price controls would impact patients’ experience, minimise treatment options, impede access to innovative medicines and reduce Malaysia’s attractiveness as a health tourism destination.

The Comprehensive Cost-Benefit Assessment (CBA 2.0) on the medicine pricing policy conducted with private industry groups from November 29 to December 6 last year is the second cost-benefit analysis of proposed drug price controls.

It covers about 5,000 products, expanding the product scope beyond the first cost-benefit analysis, with MPC describing this latest review as a “more holistic impact assessment” of proposed drug price controls through “data-driven insights”.

This is the fourth part in a series of stories on the “Comprehensive Cost-Benefit Assessment on the Medicine Pricing Policy (Preliminary Findings)” document by the Malaysia Productivity Corporation on its public consultation from November 29 to December 6, 2021.

Part One: Medicine Price Controls May Erase RM206Bil From Economy

Part Two: Medicine Price Controls: Clinic Closures, RM31Bil Wage Loss In Private Health Care

Part Three: Medicine Price Controls Benefit Rich The Most, Poor The Least

Part Five: Medicine Price Controls Risk Malaysia Losing Innovative Drug Launches