KUALA LUMPUR, August 30 — A group representing medical practitioners has criticised the low payments for panel general practitioners (GPs) under the Madani Medical Scheme (SPM) that it says is administered like a third-party administrator (TPA).

ProtectHealth Corporation Sdn Bhd, a company fully owned by the Ministry of Health (MOH), caps consultation fees for panel GPs under SPM to a mere RM30 – ironically even lower than the RM40 payment for the Peka B40 health screening programme that is also run by ProtectHealth, even though SPM provides more complex care, i.e: treatment for acute cases.

The Federation of Private Medical Practitioners’ Associations, Malaysia (FPMPAM), the Medical Practitioners Coalition Association of Malaysia (MPCAM), the Organisation of Malaysian Muslim Doctors (Perdim), and the Malaysian Medical Association (MMA) had asked for RM50 consultation fee under SPM in a meeting with ProtectHealth last May, before the launch of the programme in June, according to FPMPAM.

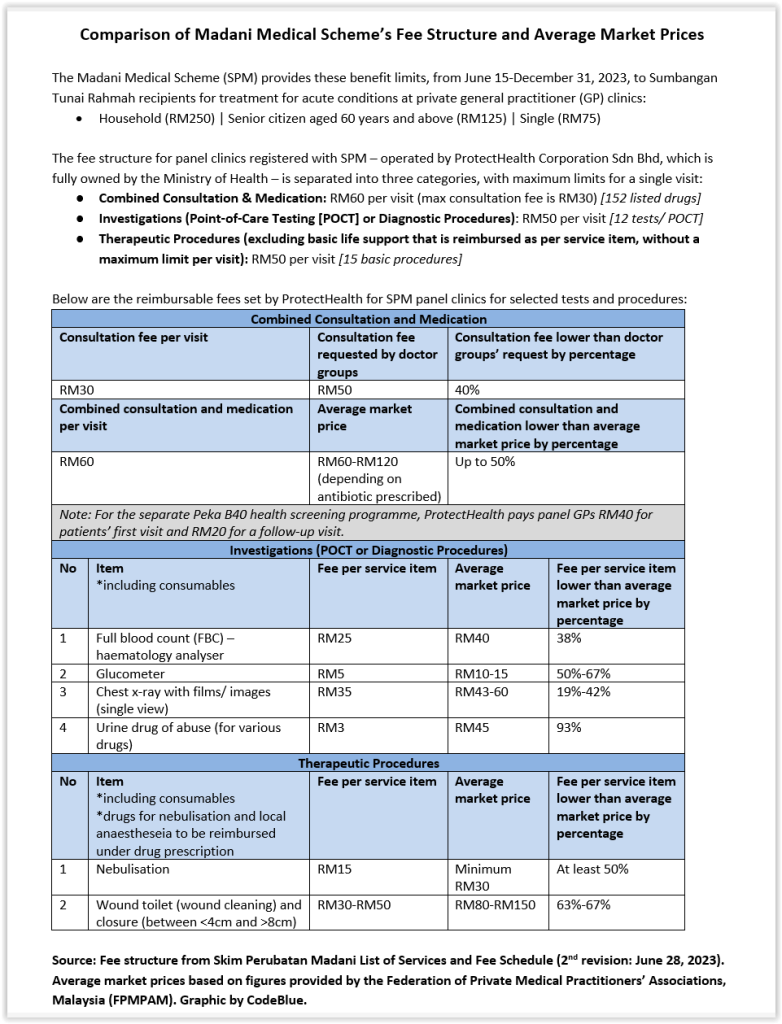

ProtectHealth’s reimbursement limits for tests, basic procedures, and medications prescribed and dispensed by panel GPs under SPM are also significantly below market prices, doctors say.

FPMPAM president Dr Shanmuganathan Ganeson said the maximum RM30 consultation fee set by ProtectHealth for SPM was an insult to doctors, noting that clinic GP fees have remained static for more than three decades.

The lack of a raise to clinic GP consultation fees over a whopping 31 years was due to the failure of previous administrations to gazette a 2013 amendment to Schedule 7 of the Private Healthcare Facilities and Services Act (PHFSA) 1998.

The Schedule 7 amendment raised clinic GPs’ consultation fees from RM10-RM35 to a new range of RM30-RM125, the same rate for hospital-based GPs in an amendment to Schedule 13 that was gazetted in 2013, unlike Schedule 7 that has never been gazetted.

The RM10-RM35 rate from the 2006 Schedule 7 was based on a 1992 rate recommended by the MMA. Clinic GPs’ consultation fees have yet to be deregulated, despite a Cabinet decision on the deregulation back in December 2019 under then-Health Minister Dzulkefly Ahmad.

“Entities such as ProtectHealth and other TPAs need to wake up to realities on the ground, rather than play bully on economies of supply and demand,” said Dr Shanmuganathan in a written response on SPM to CodeBlue.

While SPM, which provides low-income earners fully subsidised treatment for acute cases in private GP clinics, subject to certain limits, appears to be popular with patients, dissatisfaction on the other side of the spectrum – health care providers – may pose a significant stumbling block to the success of the programme.

SPM – which will be expanded nationwide next month, just three months after its launch last June 15 – was merely allocated RM100 million by the federal government, lower than the RM125 million allocated by the Selangor state government to the similar Skim Peduli Sihat (SPS) during its 2016 launch – for only the state’s residents.

Consultation Fee Capped At RM30; Certain Tests, Procedures, Medications Between 19% And 93% Below Market Price

The above table lists reimbursable fees set by ProtectHealth for SPM panel clinics for selected tests and procedures, based on the SPM List of Services and Fee Schedule, as sighted by CodeBlue; the average market prices are derived from figures provided by FPMPAM.

Dr Shanmuganathan told CodeBlue that FPMPAM, MPCAM, Perdim, and MMA had an SPM pre-launch meeting with ProtectHealth last May 16.

“The fees offered were low. We wanted a consultation fee of RM50. They offered a fee of RM60, including medicines. They also gave a list of prices for medicines, which were unbelievable!

“We told them so and said we cannot agree as this will become a reference for future pricing (if the National Health Care Financing materialises). There were no changes after the meeting, though they said they would review.”

The FPMPAM president said that despite feedback from medical associations, the SPM pilot project did not appear to have instituted suggested changes, especially with regards to GPs’ consultation fee under the scheme.

“The end result is an unattractive proposition, with many clinics shying away from the project,” Dr Shanmuganathan said.

“After the ProtectHealth stakeholder meeting, the medical associations have been kind not to echo their dissent due to the recent state elections. Generally, they seem to have adopted a neutral stance, leaving their members to make their own business decisions and caveat emptor.”

Not a single medical group has issued statements endorsing SPM or publicly encouraged GPs to join the scheme.

Confusion Among Patients Over Benefit Limits

Besides GPs’ dissatisfaction over the low rates offered by ProtectHealth for SPM, another key issue that emerged was confusion among patients over benefit limits in the federal government’s medical subsidy scheme, FPMPAM said.

SPM benefit limits for Sumbangan Tunai Rahmah recipients and dependents (RM250 per household; RM125 per senior citizen aged 60 and older; and RM75 per single) are applicable from June 15 to December 31, this year.

The acute primary care services covered by SPM include cough and cold; diarrhoea and vomiting; sprains and strains; headache; and mild trauma. Services excluded from coverage include routine vaccination, health screening, routine follow-ups for chronic disease, and family planning, among others.

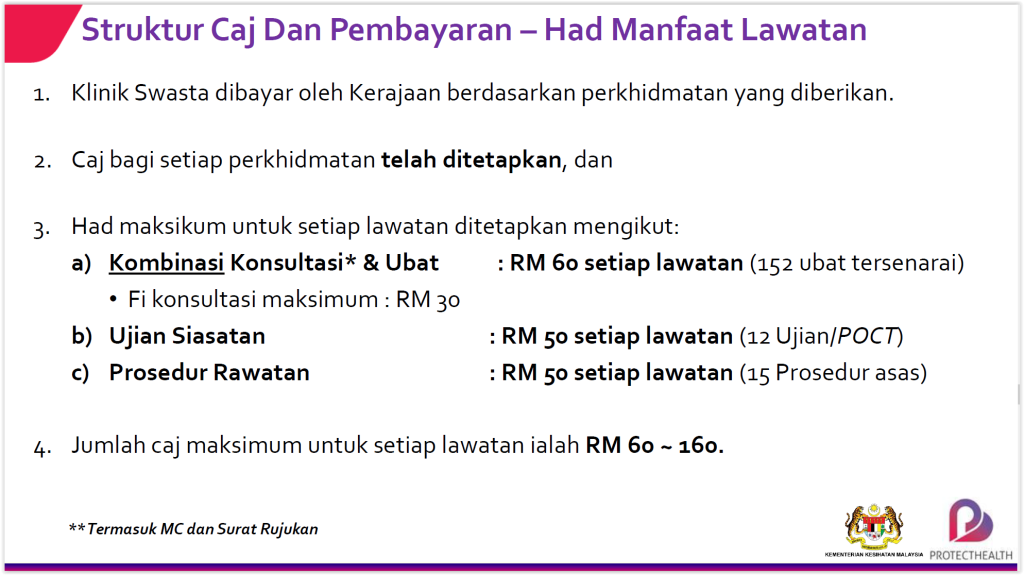

Given that ProtectHealth’s fee structure limits combined consultation and medication to RM60 per visit [RM30 maximum for consultation], investigations to RM50 per visit, and therapeutic procedures (excluding basic life support) to RM50 per visit, most potential beneficiaries would likely only be able to make one visit to an SPM panel clinic in six months this year since the June 15 launch.

However, according to ProtectHealth’s July 24 slides published by an MOH hospital’s website, the company stated that for any remaining benefit of more than zero, SPM recipients are eligible for one more visit with “full coverage for services, subject to the maximum limit per visit”.

“Private clinics are prohibited from imposing additional charges to recipients for services provided under the Madani Medical Scheme”.

Yet, ProtectHealth’s own slides also state that the “maximum fee that can possibly be charged per visit is between RM60 and RM160”; the upper limit exceeds the maximum benefit for seniors, singles, or members in the smallest household of two.

FPMPAM’s Dr Shanmuganathan said there are public misconceptions that the SPM benefit limit is RM250 per person, rather than per household.

“Most GP clinics already have third-party arrangements and are aware of the limitations imposed. The doctors are in no position to absorb costs. If patients don’t pay, the TPA doesn’t pay, the remaining alternative is that one can expect a token consultation fee imposed by a government TPA to desperate clinics,” he told CodeBlue.

“It is time to have proper GP consultation fees that are sensitive to inflation, and rise in overheads and staff salaries. So here, the danger is the conflict of interest now that MOH has its own TPA – will the MOH bite itself?”

ProtectHealth’s website describes itself as a “health care scheme administrator”, a not-for-profit company that coordinates, administers, and manages initiatives related to the financing of health care services as mandated by MOH.

“The government and MOH have seen fit to create a corporate layer in the form of a government MCO (managed care organisation), which is what ProtectHealth is. To appease stakeholders, they have declared that they are not-for-profit,” Dr Shanmuganathan said.

“In reality, it may turn out to be a ‘for-loss’ entity with taxpayers bearing the burden. Many government companies have, after all, failed.”

CodeBlue has requested comments from ProtectHealth on a number of issues on SPM.

This story is the first part of CodeBlue’s series on SPM:

- Part 2: MPCAM: ProtectHealth Promised To Approve Excess Madani Medical Scheme Claims

- Part 3: MMA Praises Madani Medical Scheme, But Admits Doctor Fees Inadequate

- Part 4: FPMPAM Questions ‘Lofty’ 1,000 Madani Patients Monthly Target Per Clinic

- Part 5: Madani Medical Scheme Doctor Fees Under Review: Minister