KUALA LUMPUR, June 17 – Medical costs in Malaysia climbed at an average of eight to nine per cent annually between 2013 and 2018, similar to the annual global inflation trend of eight per cent, according to a study commissioned by the insurance and takaful industry.

The study, examining more than four million claims from 50 insurers and takaful operators over the six-year period, found that medical claims inflation – defined as the average cost of hospitalisation coverage – rose at an average annual rate of eight per cent in the six years from 2013 to 2018.

Non-surgical treatment costs rose 9.3 per cent annually on average, while surgical treatment costs increased by 7.8 per cent per annum throughout the study period. The findings of the study by Actuarial Partners Consulting Sdn Bhd (AP) was presented by the Insurance and Takaful Industry Joint Task Force in December 2021, as sighted by CodeBlue.

The joint task force comprises members from the Life Insurance Association of Malaysia (LIAM), Malaysian Takaful Association (MTA), and the General Insurance Association of Malaysia (PIAM).

The AP study identified five key drivers contributing to the yearly increase in private medical costs and claims in Malaysia, namely advances in medical treatment, imported equipment and medicine, high prevalence of non-communicable diseases (NCDs), ageing population, and increasing benefits and policy design.

The introduction of new and better medical treatments, diagnostics, and medicines often results in higher costs. To keep up with patients’ expectations, private hospitals and doctors are constantly sourcing for and investing in the latest equipment and medicine.

Some of the new procedures introduced in recent years include minimally invasive surgeries, interventional procedures (neurology, cardiology, vascular), transcatheter aortic valve implantation (TAVI), bariatric surgery, oncology immunotherapy, and robotic surgery.

Many of these equipment, supplies, and medicine are imported from abroad – leaving the trade vulnerable to currency fluctuations.

The ringgit fell against the US dollar from 3.06 in 2012 to 4.48 in 2016. Over the same period, the ringgit weakened from 4.03 to 4.71 against the euro. The depreciation of the ringgit against major currencies was a key driver of inflation during that period.

Despite yearly increases in the cost of care, medical costs in Malaysia are still reasonable when compared to other countries, the study noted. Private medical care in Malaysia is generally lower than many neighbouring countries such as Singapore and Thailand.

Meanwhile, unhealthy lifestyles and eating preferences have led to a high prevalence of NCDs in Malaysia, including diabetes, high blood pressure, high cholesterol, and obesity.

According to the National Health and Morbidity Survey (NHMS) in 2019, about 50.1 per cent or 10 million Malaysian adults were classified as overweight or obese. Approximately 18.3 per cent or 3.9 million Malaysian adults had diabetes, 15.9 per cent (3.38 million adults) have hypertension, and 38 per cent (8.09 million) have high cholesterol.

The high prevalence of chronic disease translates to higher risks of long-term care, interventions, and hospitalisations.

Malaysia’s ageing population is also a key driver of medical inflation in the country. The World Bank estimates that 14 per cent of Malaysia’s population will be above 65 years of age by 2044, double the seven per cent projected in 2020. By 2056, over 20 per cent of the population is expected to be above the age of 65.

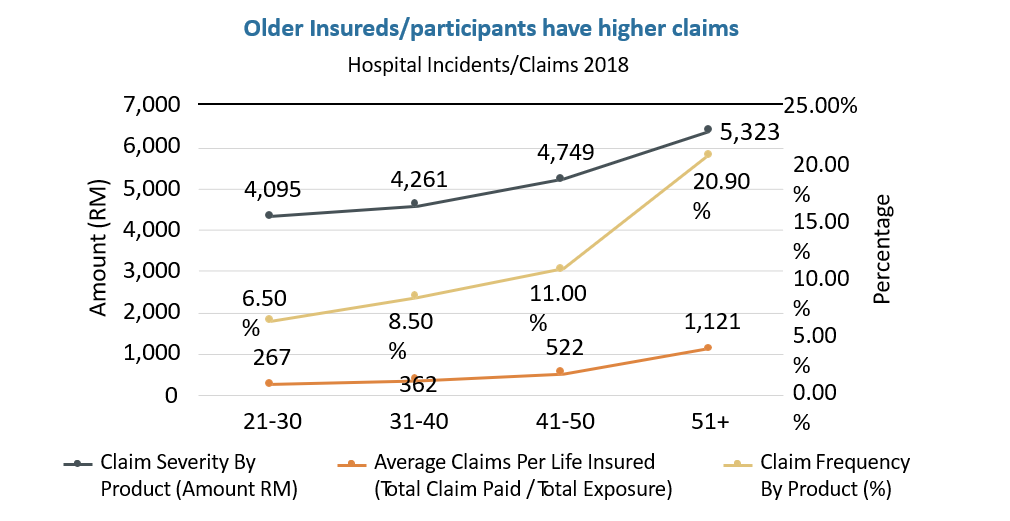

“The need to be hospitalised as well as the severity and costs of treatment increases as one gets older. Individual medical insurance or takaful premiums are designed to increase in age bands, usually every five years, as a policyholder ages to keep pace with the expected need to claim,” the study noted.

The AP study found that the amount of claims per person for insured participants above the age of 51 was more than double of insured participants aged 41 to 50 and three times higher than insured participants aged 31 to 40.

Age-related diseases include cardiovascular diseases, hypertension, cancer, osteoarthritis, osteoporosis, diabetes, incidences of multiple diseases in persons, dementia, and Alzheimer’s disease.

The study also attributed insurance or takaful policy designs as a driver of medical inflation.

“Increased benefits with liberalised conditions over the years have added to the increase in claims. Most policies today cover 100 per cent of the hospital admission through a ‘cashless’ card facility.

“Given the lack of immediate financial incentive to conserve costs, policyholders often consume more services than are normally required. In addition, patients are often in no position to question the need for services and procedures,” the study stated.

Life insurers and family takaful operators typically re-price premiums when claim levels become unsustainable, typically every three to five years. This leads to a “shock” increase when premiums are adjusted for multiple years of inflation.

Policyholders may receive a premium increase of 20 to 30 per cent or higher, which represents multiple years of inflation adjustments.

“In reality, the actual annualised increase of premiums is much lower. A recent survey of all medical and health insurance (MHI) premium repricing by LIAM members from 2017 to 2021 revealed an average annualised increase of 6.47 per cent, which is less than the annual rate of medical claims inflation of 8 per cent.

“Shock rate increases can result in many healthy insureds leaving one insurer to go to another where the rates have not been recently adjusted. This leaves behind a smaller and less healthier pool of insured participants, which can in turn lead to higher claims and premiums going forward,” the study noted.

In recent years, claims have been increasing at a faster rate than premiums. For LIAM members, expenses and operational costs fell from 10.5 per cent to 9.1 per cent of premiums from 2017 to 2019, while claims rose from 80.2 per cent to 88.6 per cent of each premium dollar.

In a survey of LIAM members, the average margin for MHI business for 2017 to 2019 was 6.9 per cent, before subsequently falling to just 2.3 per cent in 2019, with many insurers incurring losses on MHI business.

“The rising costs of health care must be paid for either by increasing policy premiums or certificate contributions or by increasing out-of-pocket (OOP) costs from the patient needing medical care,” the study noted.

Moving forward, the Insurance and Takaful Industry Joint Task Force suggested several plans, including introducing more alternative plan designs with lower premiums or contributions and cost sharing provisions for policy or certificate holders to maintain their medical coverage and encourage cost control.

The task force also recommends moving to annual pricing cycles to reduce the “shock” rate increase and incidents of healthy insured participants leaving for premiums that are temporarily cheaper.

Engagement with stakeholders – doctors, private hospitals, insurers, and regulators – is required to explore ways to curb unnecessary expenses, while greater transparency in publishing the average costs of common procedures and treatments (itemised billing and explanation on availability of treatment alternatives) are needed.

Guarantee letters should also be automated and digitised to reduce administration costs and improve the insured patient’s experience.

“The insurance and takaful industry is responding to questions and concerns regarding the rising costs of medical insurance premiums.

“There are multiple drivers to escalating costs of private medical care and the resulting rising costs of medical insurance premiums.

“All stakeholders, including insurers and takaful operators, private hospitals, doctors, regulators and policyholders must work together to address the challenges contributing to rising costs and premiums,” the task force stated.