PETALING JAYA, Jan 10 – The introduction of a payroll-funded social health insurance scheme can add an estimated RM31.1 billion to fund health care spending, in addition to Ministry of Health (MOH) allocations from the federal budget, a health advocate said.

Galen Centre for Health and Social Policy chief executive Azrul Mohd Khalib said a social health insurance scheme akin to Socso’s Employment Insurance System (EIS) and payroll contributions to the Employees Provident Fund (EPF) can collect between RM780 million annually and RM31.1 billion per year, the latter matching EPF’s contribution model.

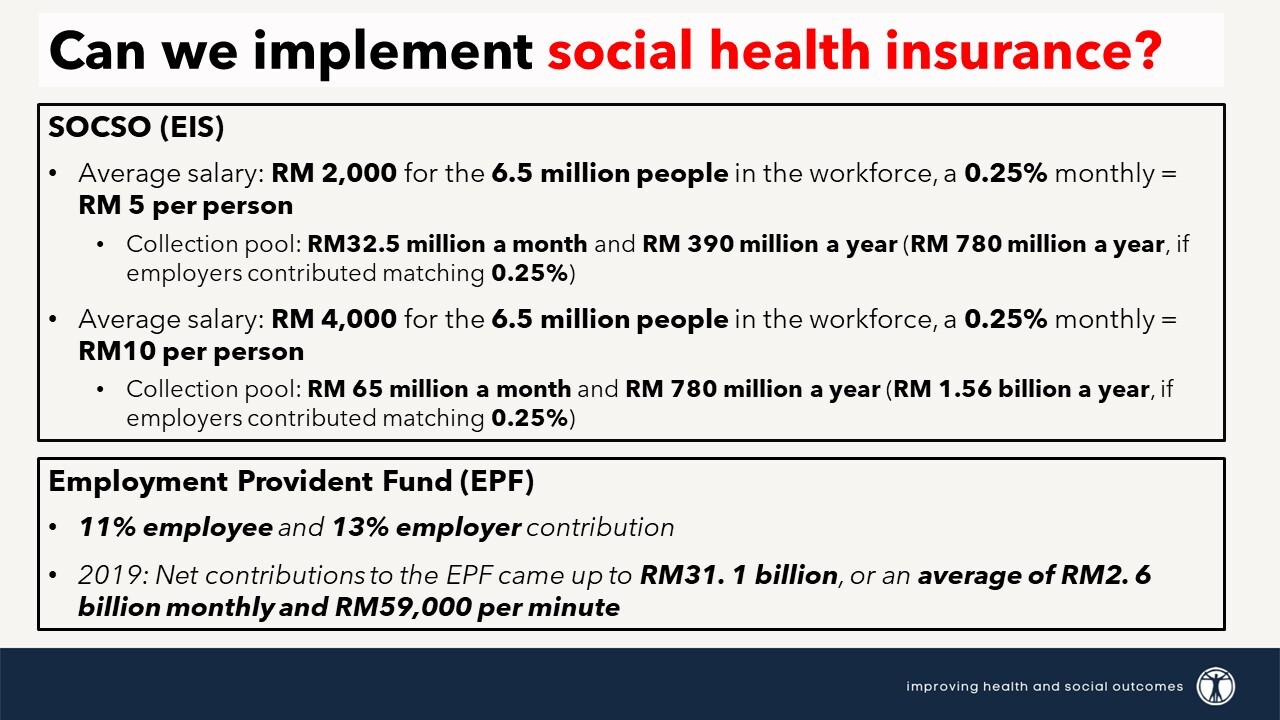

“If you were to be looking at an average of RM2,000 for the 6.5 million people in the workforce, we’re looking at 0.25 per cent monthly, which translates to around RM5 per person, you basically find that you’re able to collect in a year around RM780 million, if it includes employer contributions.

“If the average salary is around RM4,000 for the same number of people in the workforce with, again, 0.25 per cent monthly, which collects around RM10, we see around RM1.56 billion.

“Now, this is the EIS. Many of you don’t even realise it anymore. You know, you get your pay slip, right? I mean this is a miniscule amount. But a lot of people don’t actually realise that that is going to EIS, that if you’re unemployed, it will help people. But it’s small enough that people don’t notice it. And it was introduced and is able to be done. And that I would consider to be the minimum.

“If you look at EPF, EPF is more ‘atas sikit’. So 11 per cent employee, 15 per cent employee contribution. In 2019, they basically collected RM31.1 billion, RM59,000 per minute. Now, this is a little bit more lah so it’s a lot more than what you would want to contribute but that gives you an idea of how much money you could collect.

“This is payroll taxes and I have to say, whatever we introduce today, it’s going to add on an additional payroll tax. It is incredibly unpopular,” Azrul said during a presentation at the 6th Health Economics Forum 2022 here last November 24 that was organised by the Health Economics Outcomes Research (hEOR), a unit of the Galen Centre for Health and Social Policy.

The forum was co-organised by the Pharmaceutical Association of Malaysia (PhAMA) and MOH.

“This is one way for us to move forward. This gives you an idea of how much money we can collect. The reality here is this, social health insurance is not intended to replace the existing allocation that we have today.

“So I’m not going to say to the government, it’s okay, no need for the RM32 billion, we’ve got social health insurance. We need, whatever allocation given by the government to continue, and for social health insurance to complement that so that it can address the gaps that exist within the way we approach treatment and care today.

“Social health insurance will get us to where we want to be concerning getting the kind of treatments that we are seeing being made available across the Causeway, in other countries, even in Thailand, we need to fund that and this is a way forward. Adding another payroll tax into our payslips is going to be the hard reality that we have to face,” Azrul said.

New Money Into The System Every Year

The Galen Centre is proposing a maximum 5 per cent contribution for the social health insurance scheme, including a matching 5 per cent employee contribution, which can contribute between RM15 billion and RM17 billion.

Azrul said not only will a social health insurance scheme introduce funds that can be used immediately, annual contributions would mean that the mechanism can be sustained in the long run, unlike tapping into the national trust fund or heavily relying on added contributions from state-owned oil and gas company Petronas.

“This is not money from the reserves. You know, one of the solutions that has been proposed is why don’t we take money from the reserves? We did it for Covid for the vaccines. Why not take money from the reserves to fund health care?

“Now reserves are not meant to be unlimited money. You’re supposed to replace that money. I’m still scratching my head on how we can replace the money that was taken out for the vaccines. We took out X billion from the reserves, we have to replace that money.

“But if you depend on that to fund the increases for health care expenditure, then you are going to run out of reserves. There will be no reserve. We need a new source of funding that is able to sustainably introduce new money into the system every year,” Azrul said.

Former Finance Minister Tengku Zafrul Aziz in April last year announced that the government will be using RM5 billion from the National Trust Fund (KWAN) to expedite the purchase of Covid-19 vaccines.

Tengku Zafrul said the fund had RM19.5 billion, as of December 31, 2020, made up of contributions from Petronas worth RM10.4 billion and RM9.1 billion from investment returns.

The government initially estimated it would need RM2.3 billion to vaccinate 80 per cent of Malaysia’s population. However, the allocation was later increased to RM3.5 billion to cover the purchase of booster shots and vaccines for adolescents below the age of 18.

It was raised further to RM3.9 billion with an additional RM400 million allocated for vaccine purchase under the Pemulih package announced in June. This was attributed to the additional procurement of 12.8 million Pfizer vaccine doses to address shortage issues after Gamaleya’s Sputnik V coronavirus vaccine failed to get regulatory approval on time.

However, according to Parliament’s Public Accounts Committee (PAC) Covid-19 Vaccine Procurement report tabled in December last year, Malaysia’s overall contract value for Covid-19 vaccine procurement has hit RM4.1 billion.

Azrul also argued that windfall taxes are unpredictable and unsustainable in the long run, while proposals to reintroduce the Goods and Services Tax (GST) will not go well with the public.

“When we talk about things like windfall taxes, how many times can we have windfall taxes? Like we can tax Top Glove Corporation Bhd for their windfall during the Covid crisis, but not every year is a windfall.

“You won’t be able to get as much money from those kinds of players in the kind of amounts that you need in order for us to be able to sustainably have it every year.

“If 1MDB (1Malaysia Development Bhd) didn’t happen, or better still because we’re talking about today, if we managed to get all that 1MDB money back, all of it, every single cent, then we would be able to fund health care better for maybe two years.

“What about the next three, four or five years? How are we going to fund that? And the fact is, when a majority of the population don’t make enough to be taxed, it’s really a problem,” Azrul said.

On GST, Azrul said: “Nobody is going to support the reintroduction of GST from a populist perspective, because people campaigned to get rid of it and became government because they campaigned on that promise.

“We should reintroduce the GST because the GST contributed RM60 billion into our coffers. And somehow, we just signed it off and RM60 billion was gone.

“We need that money back so we can fund, not just health, but everything else as well, right? But do you see that happening in the next five years? Possibly not. So, we need to be able to come up with policy proposals that possibly can be implemented but also palatable.”

Local Insurance Market To Get ‘Huge Competitor’

Azrul said the introduction of social health insurance could also help lower private health insurance premiums and private hospital charges as the government would be introducing a “huge competitor” into the local market.

Azrul also said that the social health insurance scheme should be managed by a statutory body such as EPF or Socso to ensure that funds are properly managed and allocated.

“If we introduced this, this could actually compete with private health insurance and may, in fact, contribute to them lowering their premiums [and] for private hospitals to also reduce the amount that they’re charging private insurance.

“We are introducing a huge competitor into the local market. It could have positive benefits in terms of people who hold private policies. You know, costs such as chemo also have pooling of risk and resources.

“We need a statutory body meaning we need something like EPF and Socso to manage this fund, so it cannot just be part of the MOH. It needs to be a statutory body that is given a mandate for that. It needs to have access to both private and public health care services.

“And they can use the existing GP network to facilitate gateway access.

“So essentially, we’re making, like an orchestra, we are making everybody playing together, not in competition, which is sometimes what we have today, but to work together to benefit all Malaysians in a way that is equitable, is sustainable and most importantly, future proof for the challenges not only today, but tomorrow,” Azrul said.