KUALA LUMPUR, Sept 29 — The latest Auditor-General’s report has found that the government’s mySalam health protection scheme, which provides beneficiaries critical illness and hospitalisation benefits, lacks transparency and accountability.

According to the National Audit Report 2019 Series 2 released in Parliament yesterday, the current clause under the mySalam Fund Order is incomplete as it does not state the Finance Ministry’s role in the scheme as well as reporting requirements to the Cabinet, Parliament, and other stakeholders.

Standard operating procedures detailing the scope and limits of the board of trustees are also absent, while the expansion of the mySalam scheme was implemented without amending the mySalam Fund Order.

“Overall, based on the scope of the audit, it can be concluded that the mySalam scheme has provided takaful/ income replacement protection to the B40 group against certain critical illnesses and admissions into hospital wards.

“However, the governance of private trust accounts does not provide adequate internal controls and clear check-and-balance mechanisms to ensure accountability and transparency in the scheme’s reporting,” the audit report stated.

The report also noted that the single appointment of a mySalam takaful operator prevents other local insurance companies from participating in the scheme, which in turn, limits the economic benefits of the mySalam scheme.

It added that the rearrangement of the takaful scheme involved costs that are unreasonable as no comprehensive study was conducted on the rearrangement plan.

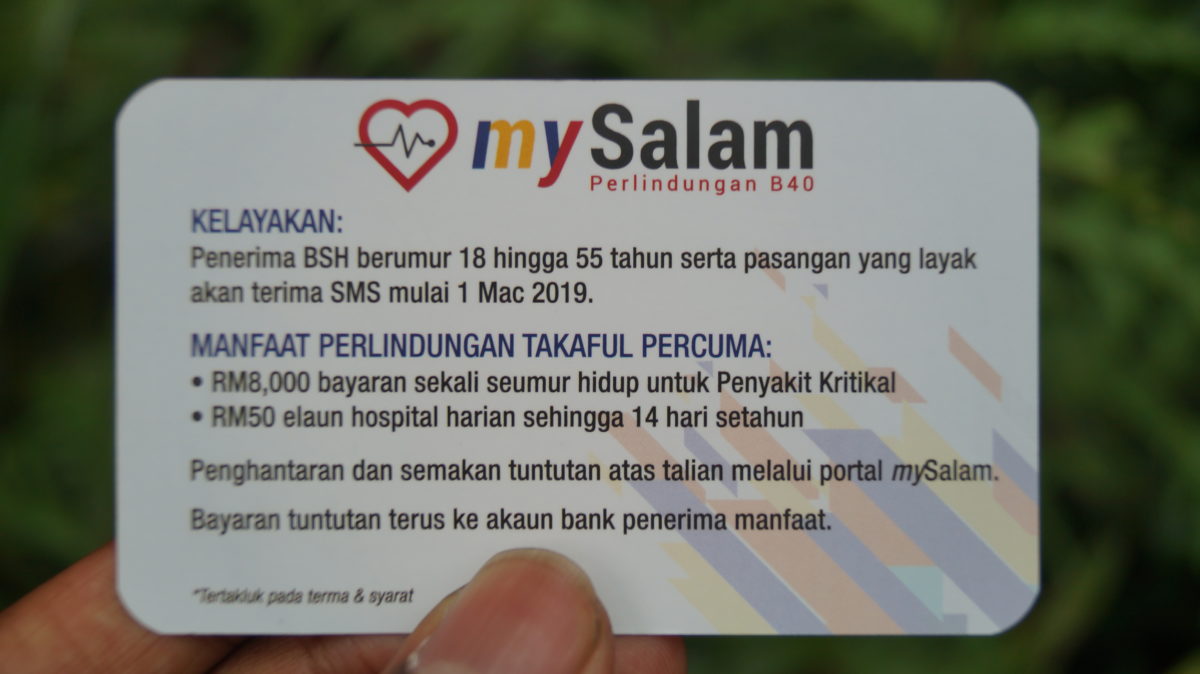

mySalam was set up by the then-Pakatan Harapan government in 2019. The scheme provides low-income beneficiaries an RM8,000 lump sum for a critical illness diagnosis and a maximum RM700 per annum for up to 14 days’ hospitalisation for any condition.

Singapore-based insurance company Great Eastern is meant to contribute RM2 billion to the mySalam fund for five years, or RM400 million per year from 2019.

Finance Minister Tengku Zafrul Abdul Aziz told Parliament last November that mySalam paid 75,000 beneficiaries RM75 million as of October 31, just 10 per cent of funds received by the government health protection scheme.