KUALA LUMPUR, March 11 — As the health care system becomes increasingly unsustainable, advocates are divided on whether to add tax ringgit to the health budget or bolster it with a national health insurance.

Galen Centre for Health and Social Policy CEO Azrul Mohd Khalib proposed a compulsory national health insurance where all workers make a monthly contribution to a national pool of funds similar to current Socso (Social Security Organisation) and EPF (Employees Provident Fund) payments, based on a sliding scale linked to income and age.

“There would be collective pooling of both funding and risk. Those who are unable to pay, such as those earning the minimum wage or less than that should be exempt,” Azrul told the Malaysian Health Care Conference 2019 here last week organised by Kingsley Strategic Institute.

“People already with their own insurance should be able to keep it. They would then be able to access both public and private health care facilities. Those contributing only to the national scheme would be entitled to access the public health care system.”

Azrul said this would enlarge the purse for public health care and enhance access and quality of care.

“This will make it possible for new treatments, drugs and therapies to be introduced without solely being dependent on the yearly national budget. It would help begin addressing the issue by co-sharing the burden and responsibility of financing of the health care system.”

He pointed out that countries like Thailand, South Korea, Taiwan and Indonesia had some version of this system.

Azrul added that the ideal was a single-payer, multiple-provider system where public and private health facilities would be equally accessible, as opposed to the current multi-payer system.

According to Health Minister Dzulkefly Ahmad, Malaysia is only spending 4.5 per cent of its gross domestic product (GDP) on health care, comprising almost equal public and private sector spending, compared to average spending of 6 to 7 per cent of GDP for similar sized economies. The federal government’s 2019 budget allocated RM29 billion for health, marking an RM2 billion increase from Budget 2018.

He also reportedly admitted in an interview with Pharma Boardroom published last November that Malaysia has “reached a juncture where the system is no longer sustainable in its current form and cannot meet its financial burdens by increasing taxation.”

Rangam Bir, president and CEO of life insurance company Gibraltar BSN Life Berhad, also suggested considering social health insurance strategies funded by citizens who would have a stake in staying healthy.

“What can we learn from systems like Germany, France, Singapore?

“Citizen-funded statutory health insurance schemes comprising employer-employee contribution is part of the system, supplemented by private health insurance for additional coverage, potentially to cover co-payments. Government subsidies can be used to cover lower earning segments and the unemployed,” he told the conference.

Rangam pointed out that medical inflation has hovered at around 12 per cent in the last three years.

“This indicates that sustainability of the funding to ensure Malaysians continue to enjoy quality health care is not assured in middle term.

“This calls for us to explore alternative models for a sustainably financed health care system, including active public-private insurance marketplace,” he said.

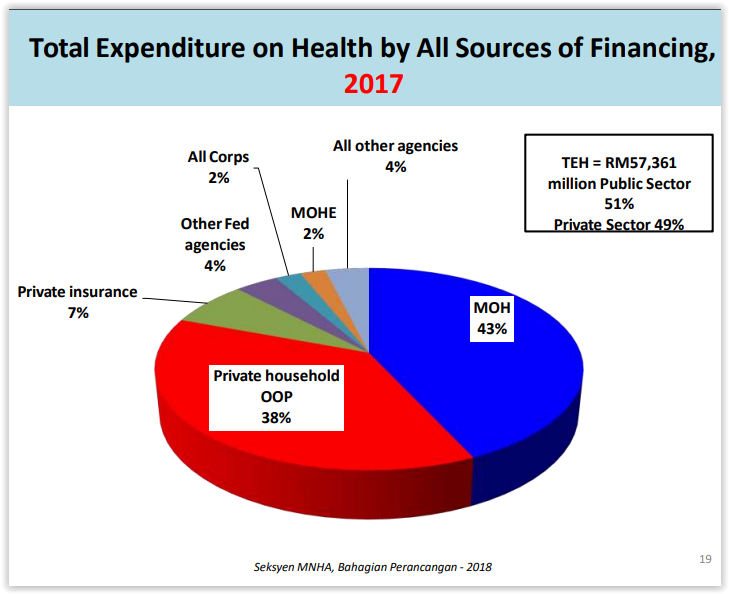

According to the Health Ministry’s Malaysia National Health Accounts (MNHA) report on national health expenditure from 1997 to 2017, the Health Ministry spent the most on health in 2017 at 43 per cent, followed by private households’ out-of-pocket spending at 38 per cent. Private insurance comprised just 7 per cent of Malaysia’s total health expenditure that year.

Malaysia’s total expenditure on health in 2017 totalled RM57.4 billion, with public sector and private sector spending comprising 51 per cent and 49 per cent respectively.

Chua Hong Teck, a senior adviser at nonprofit Research Triangle Institute, however advocated retaining the current tax-based system to fund public health care.

“They want to do social health insurance. We will never be able to do it. Can you ask people right now to contribute money to social health insurance?

“You think people are willing to trust the government, even though it’s a new government? Will everyone contribute? No,” Chua told the conference.

He said the current tax-based system allowed for universal health coverage and stressed that what was important was not the amount of health care spending, but the outcome.

“Everyone in Malaysia says there’s very good outcome. If it’s good then 4.4 per cent [of GDP spending on health care] is enough lah.”

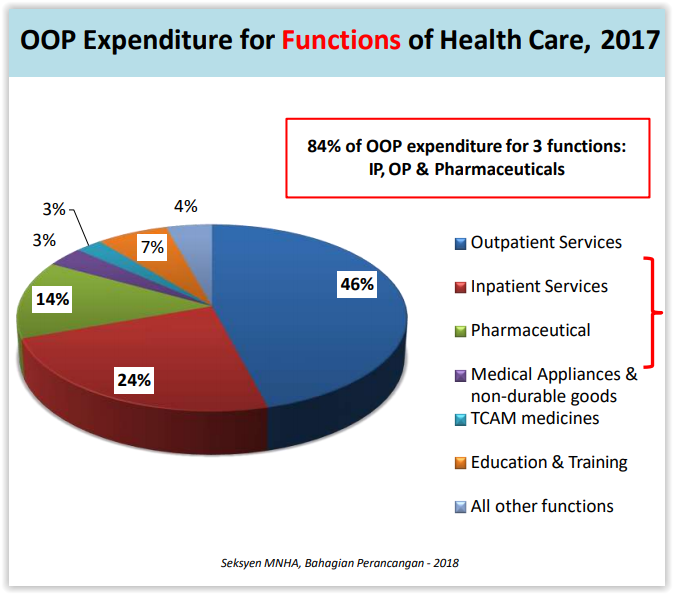

Chua also said although OOP spending comprised 38 per cent of Malaysia’s total health expenditure in 2017, almost half of the OOP spending, or 46 per cent, was on outpatient services, whereas just 24 per cent was on inpatient services.

“GP services are relatively cheap, people can pay OOP. If people can pay OOP, why worry?”

Private GPs have long complained about low consultation fees that have been fixed at RM10 to RM35 since 1992.