I was invited to the APEC Health Financing Dialogue and Selangor International Healthcare Conference recently to share my thoughts on this important subject, before the 15th general election and the tabling of the Health White Paper by the Ministry of Health (MOH).

The structuring of health care financing from the present tax-based financing to a better structure has been discussed since the mid-1980s. Many studies have carried by the government, and many proposals have been discussed and debated, but nothing much has changed.

MOH is keen to introduce some form of prepaid payment (like social health insurance) as a national health financing scheme, as proposed in a number of studies. This requires a major shift from tax-based financing to a contributory system, and because of this major transformation and opposition from many, this new health financing scheme has not taken off.

In recent manifestos by the various political coalitions and parties, most of them did not go into specifics on the type of health financing, except MUDA. It recommended a social health insurance model based on contributions from employers and employees, according to income and age.

While major health care financing has not taken place, nevertheless, other developments in health care financing such as foreign workers insurance (SPIKPA), Peduli SIHAT by the Selangor state government, Skim MySalam, and PeKa B40 have been successfully introduced to assist foreign workers and those in the B40 category to have better access to health services, and therefore reducing their financial burden.

The Covid-19 pandemic has tested the public health care structure and delivery system to its limit. The former health minister, in his new year’s address to MOH staff in early 2022, proposed a White Paper to reform the future health system of Malaysia.

He said that there will be more shocks to come, and we need to future-proof the health care system. This will include reformation of the financing system, and the health care burden will be shared with the people.

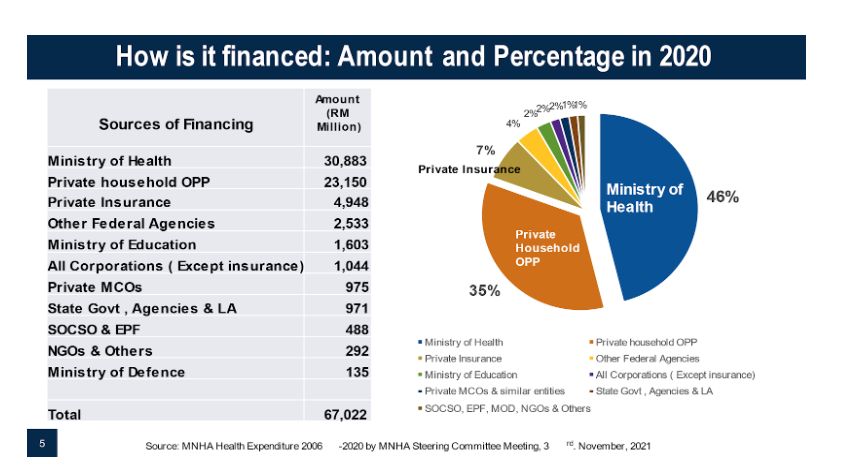

One of the major concerns of policymakers is the large out-of-pocket payment (OPP) of total health expenditure (about 35 per cent), and because of this, there is a need for pre-payment. Most studies have shown that OPP is progressively distributed and equitable as they are made by richer households.

In looking at health care financing for the future, I had to talk about the present financing system, including its sources, its functions, and the providers of health care as reported in the National Health Accounts (MNHA).

I suggested the need for a health financing philosophy, where it is the responsibility of individuals, their families, and the state to finance health, just like any other services.

Health services must be affordable to everyone, in order to protect against financial ruin. We must all be responsible in taking care of our own health, and our families’ health as well.

With regard to health care financing for the future, Malaysia will continue to have a mixed financing system. But the public health system must provide more and better resources to take care of the majority of the rakyat.

To increase and provide certainty and priority for the health budget, the federal revenue must increase. I propose that if the goods and services tax (GST) is brought back, there will be about a RM20 billion to 25 billion increase in revenue.

Part of this can be earmarked for health, and part of the revenue can be earmarked for non-communicable disease expenditure. By earmarking revenue and expenditure, MOH and other agencies that provide health services can be assured of an increasing yearly budget.

It will take some years to increase the public sector expenditure to 5 per cent of Malaysia’s gross domestic product (GDP). For those who want to opt out of the tax-based system, more incentives should be given to private insurance consumption by increasing tax exemptions, making it portable, covering pre-existing illnesses, having co-payments, and have less frills in private health care services and insurance to make it more affordable.

We should not try to force everyone to adopt a single pre-payment financing system, as it will be too disruptive to the private health and insurance system, and ultimately the health system of the nation.

If the government wants to start compulsory health insurance, they can start with new employees in the public and private sectors who are not covered by any form of health care financing. This can be the beginning of a social health insurance scheme for the future. It will take many years to develop this financing system.

I concluded by saying that the health status of a nation does not depend on health alone, but is also determined by socioeconomic determinants like income, employment, housing, and education. Therefore, health should be viewed via a whole-of-society approach.

The responsibility of health care should not be solely left to MOH, but also the government and the people. It will take time and determination to transform health and introduce changes to health care financing for the future.

This is now the time to take concrete action to transform the health care system and health care financing. Let us make Malaysia a healthy and caring nation.

Chua Hong Teck, PhD, is an independent public policy and health care analyst.

- This is the personal opinion of the writer or publication and does not necessarily represent the views of CodeBlue.