KUALA LUMPUR, Dec 7 — Out-of-pocket (OOP) health care spending in Malaysia has more than tripled from RM7.14 billion in 2006 to RM23.15 billion in 2020, with 43 per cent of OOP spending last year going to outpatient services.

By percentage of gross domestic product (GDP), OOP expenditure on health care increased from 1.2 per cent to 1.6 per cent over the period, while by share of national expenditure on health, OOP’s portion rose from 32 per cent in 2006 to 35 per cent in 2020, according to the Ministry of Health’s (MOH) National Health Accounts Steering Committee’s November 3 presentation, as sighted by CodeBlue.

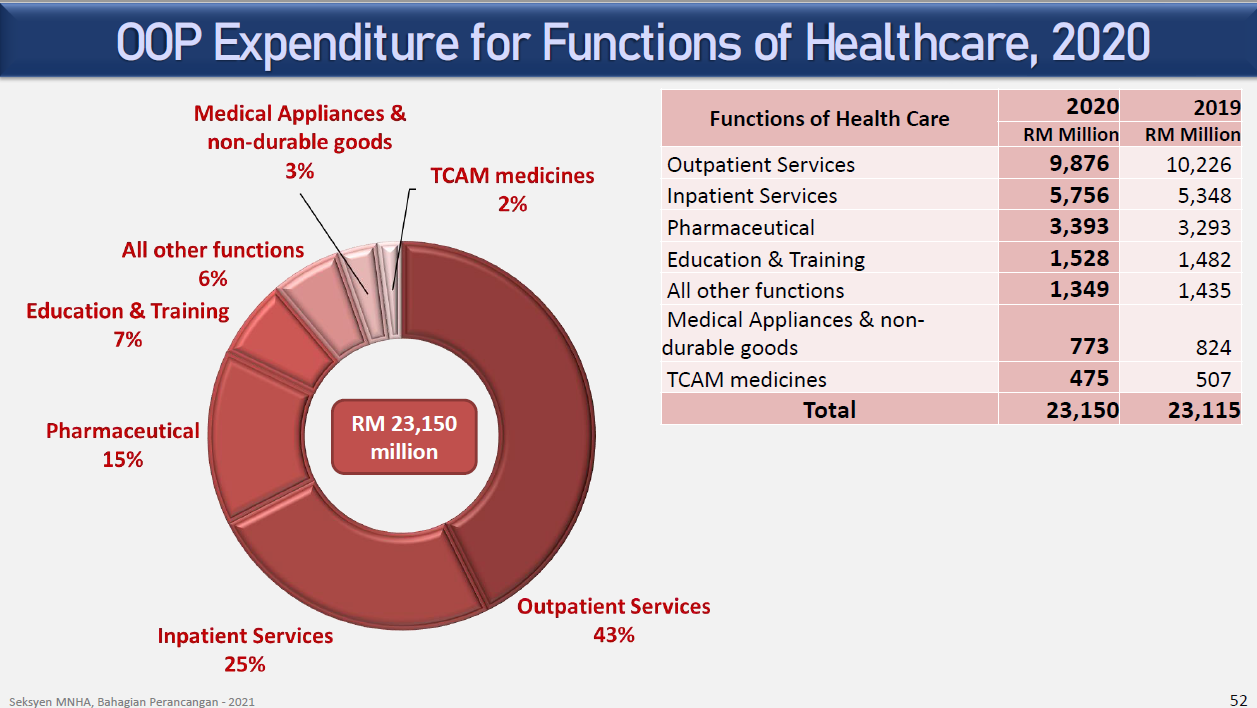

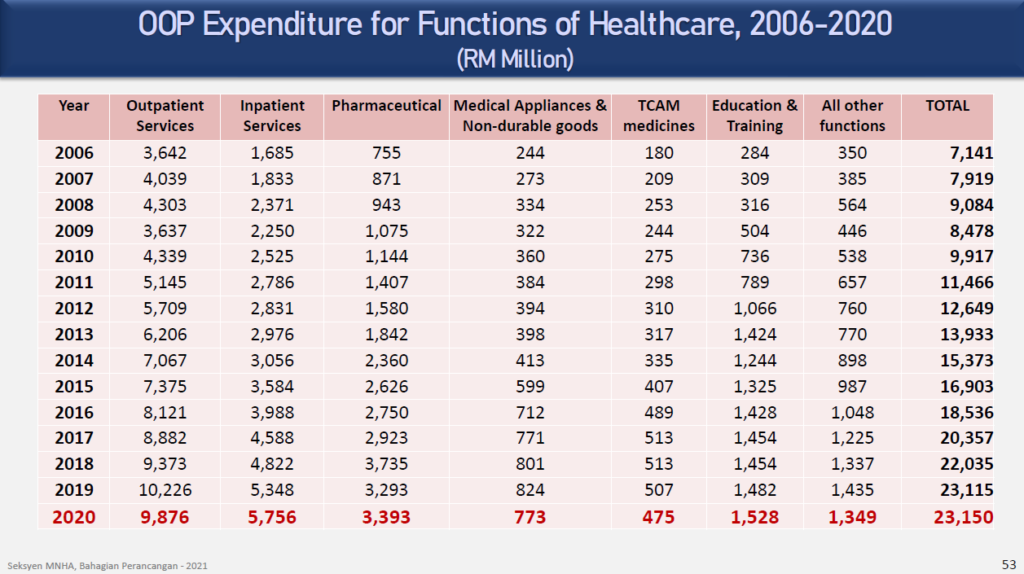

About RM9.88 billion or 43 per cent of OOP spending on health care last year were spent on outpatient services, a 3 per cent decline from RM10.23 billion spent in 2019. This is followed by inpatient services at RM5.76 billion or 25 per cent, pharmaceutical at RM3.39 billion (15 per cent), education and training at RM1.53 billion (7 per cent), and all other functions at RM1.35 billion (6 per cent).

OOP spending on medical appliances and non-durable goods amounted to RM773 million (3 per cent) in 2020, while OOP expenditure on traditional complementary and alternative medicine (TCAM) stood at RM475 million (2 per cent).

Outpatient services dominated OOP spending from 2006 to 2020, rising from RM3.64 billion to RM9.88 billion over the period.

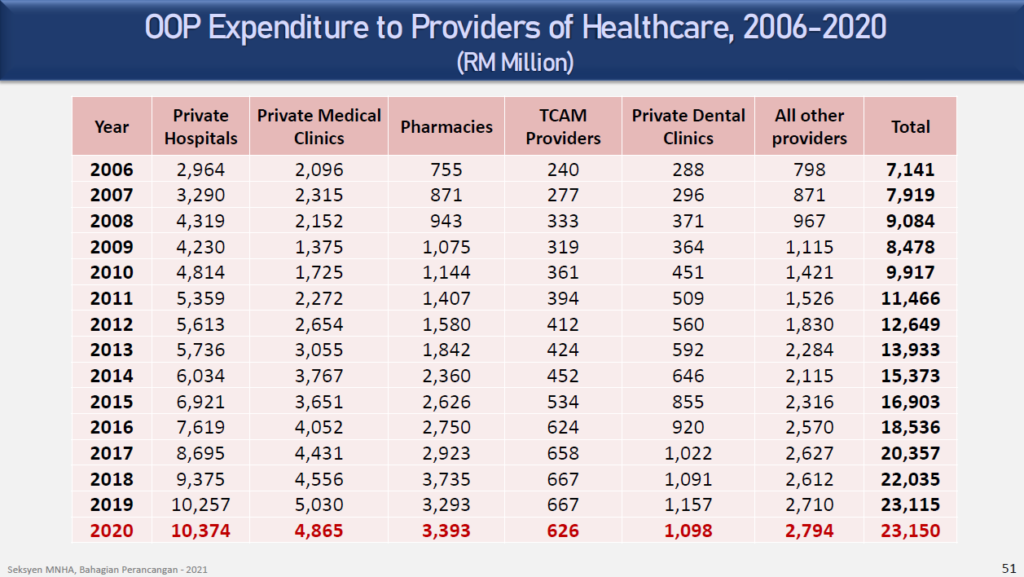

The bulk of OOP expenditure in 2020 went to private hospitals at RM10.37 billion or 45 per cent of total OOP spending for the year. This is followed by private medical clinics at RM4.87 billion or 21 per cent, pharmacies at RM3.39 billion (14 per cent), and all other providers at RM2.79 billion (12 per cent).

Private dental clinics made up RM1.1 billion (5 per cent) of OOP spending in 2020, while TCAM providers collected RM626 million (3 per cent).

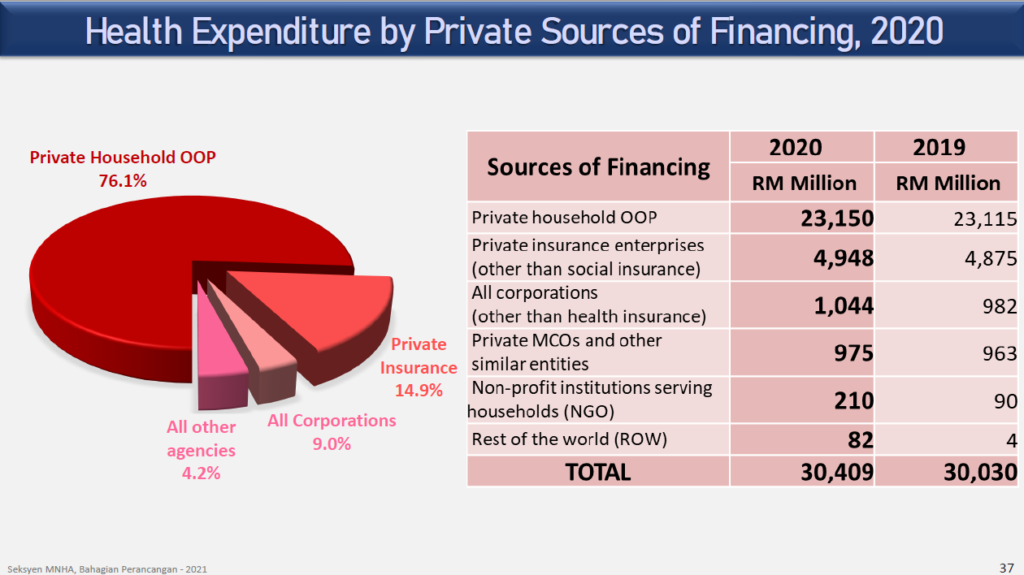

Private household OOP is the single largest private source of health financing in 2020 at RM23.15 billion. Private insurance enterprises (other than social insurance) come in second at RM4.95 billion, followed by all corporations (other than health insurance) at RM1.04 billion.

Private managed care organisations (MCOs) and other similar entities contributed RM975 million to private sources of financing for health spending, while non-profit institutions serving households spent RM210 million on health care. Another RM82 million comes from the rest of the world.

Private household OOP is also the second-largest source of financing for health care expenditure in 2020 after the Ministry of Health (MOH).

The MOH continues to be the main source of financing for Malaysia’s overall health expenses, with 46.1 per cent or RM30.88 billion coming from the ministry in 2020. MOH’s share of total expenditure on health care hovered at between 40 and 50 per cent between 2006 and 2020.

Apart from MOH, other public sources of financing for health spending in 2020 include other federal agencies at RM2.53 billion or 3.8 per cent of overall financing sources, the Ministry of Education at RM1.6 billion (2.4 per cent), state agencies at RM504 million, Socso at RM409 million, local authorities at RM266 million, state government at RM201 million, Ministry of Defence at RM135 million and the Employees Provident Fund (EPF) (RM79 million).

For the whole of 2020, Malaysia’s health care spending amounted to RM67.02 billion, comprising RM36.61 billion (54.6 per cent) from the public sector and RM30.41 billion (45.4 per cent) from the private sector.

Out of the overall RM67.02 billion figure in 2020, over half (54 per cent) or RM35.93 billion were spent in hospitals, followed by ambulatory health care at RM13.84 billion (21 per cent), general health administration and insurance at RM6.29 billion (9 per cent), medical goods at RM4.28 billion (6 per cent), institutions at RM3.46 billion (5 per cent), and other providers at RM3.23 billion (5 per cent).

Of the RM35.93 billion spent on hospitals, about 52.3 per cent or RM18.79 billion were channelled to public MOH hospitals, RM14.55 billion or 40.5 per cent to private hospitals, and RM2.59 billion or 7.2 per cent to non-MOH public hospitals.

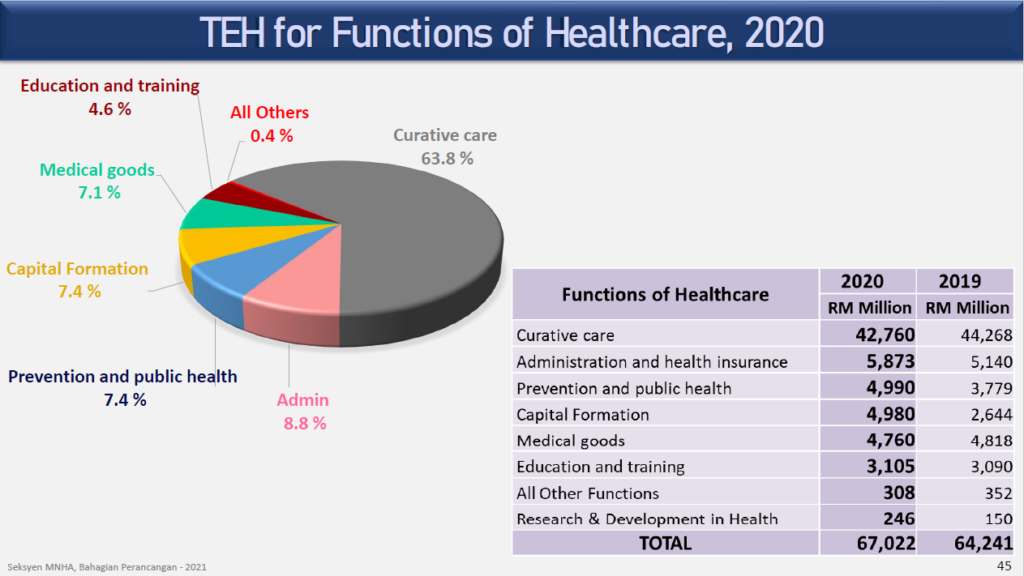

By functions of health care spending, about 63.8 per cent or RM42.76 billion of 2020’s total health care spending of RM67.02 billion were spent on curative care.

This is followed by administration and health insurance at RM5.87 billion (8.8 per cent), prevention and public health at RM4.99 billion (7.4 per cent), capital formation at RM4.98 billion (7.4 per cent), and medical goods at RM4.76 billion (7.1 per cent).

The biggest source of financing for curative care in 2020 comes from the MOH at RM18.88 billion or 44 per cent, followed by OOP expenditure at RM16.26 billion (38 per cent), and private insurance at RM4.15 billion (10 per cent).