BANGI, April 21 – A health policy expert has warned that revenue from sin taxes on cigarettes and vaping products may not be enough to cover the costs of treating smoking-related illnesses.

According to Prof Dr Syed Mohamed Aljunid, a Malaysian professor of economics, health policy and management at the International Medical University (IMU), while sin taxes are an effective way to discourage smoking and vaping, the government would need to impose a higher tax on these products to see results.

“The taxation is effective if we use the earlier method of tobacco taxation the correct way until it translates to high prices for cigarettes and vapes.

“But we know, as a whole, what is potentially raised by the taxation is truthfully not able to cover whatever costs that are involved in providing treatment for those who contract disease caused by vaping and smoking,” said Dr Syed Mohamed at a roundtable on the Control of Smoking Product for Public Health Bill 2023 and Implementation of the Generation End Game (GEG) Provision held at the Tenera Hotel here on April 17.

Dr Syed Mohamed, who is a council member of the Health White Paper (HWP) advisory council, highlighted the theoretical effectiveness of the sin tax method in discouraging non-smokers from taking up tobacco use and encouraging existing users who might be hard on cash to quit.

The tax can also work as an incentive to prevent former smokers from returning to the habit and prevent occasional smokers from becoming regular smokers. However, Dr Syed Mohamed contends that a tax rate of at least 75 per cent of the price of cigarettes or vape would be necessary in order to achieve these benefits.

“It will only work if the tax is translated into 75 per cent of the tobacco or vape price. If the tax is under, it will not give any effective effects, and it was also found out that the price elasticity of demand, an economists’ term, its elasticity of demand is -0.4. Meaning if we increase the price, not tax, price by 10 per cent we can lower cigarette use by four per cent,” said Dr Syed Mohamed, who previously worked with the Indonesian government to help implement a social health insurance programme and reforms of the country’s health financing system.

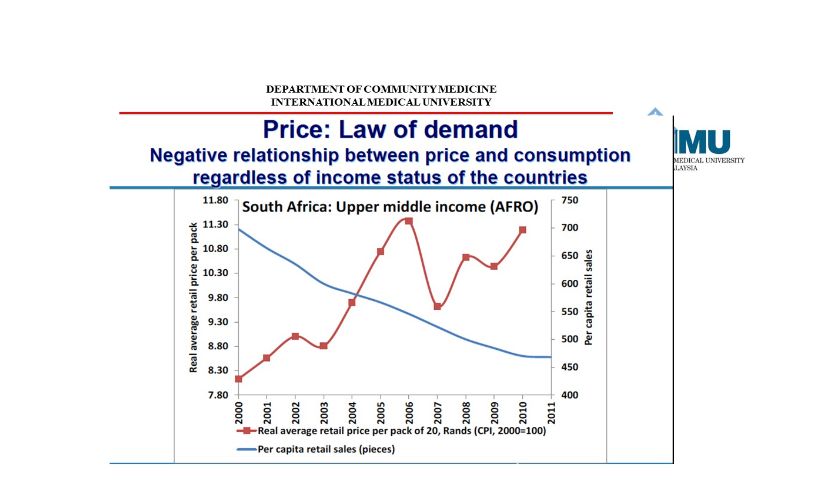

In his presentation, Dr Syed Mohamed demonstrated how a steady increase in the average retail price per pack of 20 cigarettes over a period of more than 10 years resulted in per capita retail sales of cigarettes to decline by about 30 per cent in South Africa.

During the tabling of the 2023 Budget on February 24, Prime Minister Anwar Ibrahim announced that the government plans to impose excise duties on e-cigarettes, with half of the tax revenue from vape being earmarked for the Ministry of Health (MOH).

Anwar, who is also Finance Minister, estimated the value of the nicotine market at more than RM2 billion and suggested that regulations on e-cigarettes would help to discourage their use.

However, as nicotine was under the Poisons List in the Poisons Act 1952, the government was unable to impose any taxes as the product was deemed to be illegal under the law.

To resolve the issue, Health Minister Dr Zaliha Mustafa gazetted an order on March 31 to exempt liquid and gel nicotine, despite the Poisons Board’s unanimous rejection of her proposal. The very next day, the Prime Minister put into effect a new excise duty of 40 sen per ml on e-liquids containing nicotine.

The move has left Malaysia with no regulations on vape or e-cigarettes with nicotine. The health minister – a medical doctor – targets to table the “new” Control of Smoking Product for Public Health Bill 2023 in the coming 11-day parliamentary sitting next month.

Dr Syed Mohamed said Malaysia could potentially generate up to RM3 billion per year in revenue from the taxation of cigarettes, and up to RM500 million per year from the taxation of vape products. However, these figures are contingent on the government’s ability to effectively and consistently collect taxes, a challenge that many developing countries face.

“We know that there is a study done that says that if we can increase tax revenue in Malaysia, the most we can get for a year is only around RM3 billion. That is if the tax is collected effectively and also seriously.

“We know there are many problems with collecting taxes in developing countries, and if we look at vape, [we] estimate only around half a million [is collected]. So if we look, we delay one month [or] two months, we can only collect taxes around RM500,000 to RM600,000 or RM300,000 a month.

“So, to compare. We are forced to spend, RM3 billion to RM4 billion – at least. As a whole, [for] every RM1 that we collect from the tax, actually, we spend more than two times the cost to treat the diseases associated with the use of tobacco and vape.”

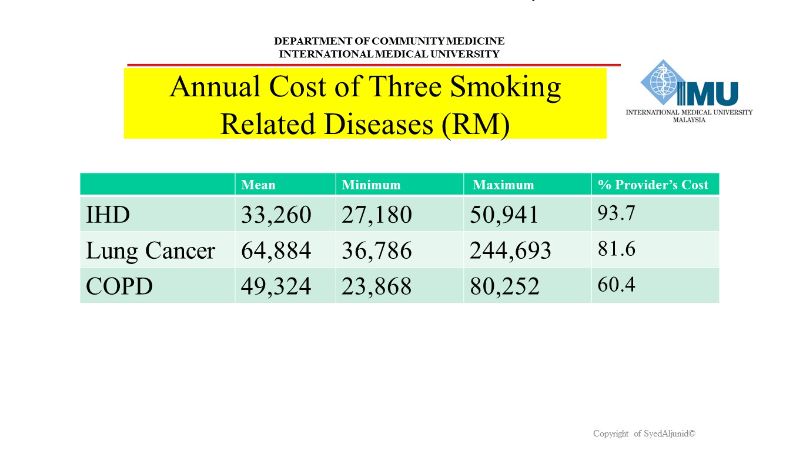

Using figures from a 2010 study, Dr Syed Mohamed analysed the costs associated with treating three smoking-related diseases: ischemic heart disease (IHD), lung cancer, and chronic obstructive pulmonary disease (COPD).

The cost per treatment for IHD ranges from RM27,180 to RM50,941, with the MOH bearing 93.7 per cent of the provider’s cost, which would be approximately between RM25,467 and RM47,731.

For lung cancer, the cost per treatment ranges from RM36,786 to RM244,693, with the MOH bearing 81.6 per cent of the provider’s cost, which would be approximately between RM30,017 and RM199,669.

Finally, the cost per treatment for COPD ranges from RM23,868 to RM80,252 with the MOH bearing around 60.4 per cent of the cost, or approximately RM14,416 to RM 48,472.

While the average cost of treating lung cancer, which stands at RM64,884, is considerably higher than the cost of treating the other two diseases, Dr Syed Mohamed emphasised that it is COPD that places a greater burden on the MOH’s resources.

This is due to the lifespan of the patient, as those diagnosed with lung cancer tend to succumb to the disease more rapidly and require less treatment. In contrast, COPD patients have a similar lifespan to that of a healthy individual, which results in longer treatment periods and higher costs.

“The problem is COPD. Their life span is almost the same as the lifespan of other people. So, every year, every episode of treatment, if they enter into the hospital, maybe they are forced to go in three, four times a year, it costs about RM50,000.

“And if we look there at the final column, that is the provider’s cost. Meaning, the government has to pay for it. If we look at ischemic heart disease, 93.7 per cent is borne by the government, only 3 per cent by the public. Next, lung cancer, 81.6 per cent, and COPD, 60.4 per cent.

“So, the burden is actually on the government. When we extrapolate this study and look at current conditions, as a whole, if we combine all three of these diseases, at the very least, for one year, we would have spent on average RM4.5 billion a year. That is together with 0.3 per cent of our GDP (gross domestic product).

“Or if they seek treatment from the ministry using the MOH budget, 12 per cent of the budget will be used to treat these patients, and around 7 per cent of the total health expenditure. This is very significant, and we are seeing these three diseases only. What about the other diseases? There are many other cancers that involve vaping and smoking.”

Dr Syed Mohamed further highlighted that the cost of treating a single episode of e-cigarette or vaping use-associated lung injury (EVALI) is nearly RM150,000.

“This is the estimate that is done per episode that will come every year, or every six months, probably. For popcorn lung, or bronchiolitis obliterans, we do not yet know how much it will cost. If it requires [a] lung ventilator and so on, the cost will increase. In one episode, the treatment [can go up to] RM30,000 to RM60,000, and remember that in our country, the majority of the cost is borne by the government.

“Almost 80 to 90 per cent of the cost is borne by the government, meaning it is borne by us. [It] is given to the citizens through the tax we pay and so on.”

According to Dr Syed Mohamed, who cited the Assessment of Association Between Smoking and All-Cause Mortality Among Malaysian Adult Population study, Malaysia has a daily smoking prevalence of 21 per cent.

Of this percentage, 39.1 per cent are male and 2.1 per cent are female. The study conducted a follow-up on participants and found that out of 213 deaths from all causes, 68 were among smokers and 452 were among non-smokers. The study concluded that daily smoking significantly increases the risk of all-cause death.

Dr Syed Mohamed held that Malaysia loses approximately 20,000 people annually due to smoking.