KUALA LUMPUR, Oct 29 — Malaysia’s health care system can be improved by cutting bureaucracy that prevents spending in public hospitals on necessary equipment and medicine, a researcher said.

Mark Cheong, public health research at Monash University Malaysia, said there is a need for greater flexibility, empowerment, and accountability for hospital spending to make sure that the amount allotted for health care in the federal budget is well spent.

“Right now, our Ministry of Health (MOH) hospitals do not actively collect revenue which they then can use to actually purchase drugs. It all goes back to the general consolidated fund and therefore, for them to get more money which they need to fund their operations, they have to apply for new warrants from this fund from the government.

“Based on my former life as a pharmacist in the public health service, we frequently see periods of time where you would run out of money to purchase new drugs simply because the warrant for additional funding from the government is pending.

“So, you have to go through a lean period of time where you have to ration drug supplies, when you have to tell patients no the quota is really limited because we don’t have the money for it,” Cheong said at Galen Centre for Health and Social Policy’s “Improving Access To Cancer Treatment And Care” virtual conference recently.

He said this in response to a question on ways to increase and improve public health spending in the upcoming Budget 2022, which is scheduled to be tabled in Parliament later today.

Meanwhile, University of Malaya clinical epidemiologist Assoc Prof Dr Nirmala Bhoo Pathy underlined the need for financial navigators to assist cancer patients and their families as high out-of-pocket treatment costs often result in depleted savings and deferred debts that end up putting these households below the poverty line.

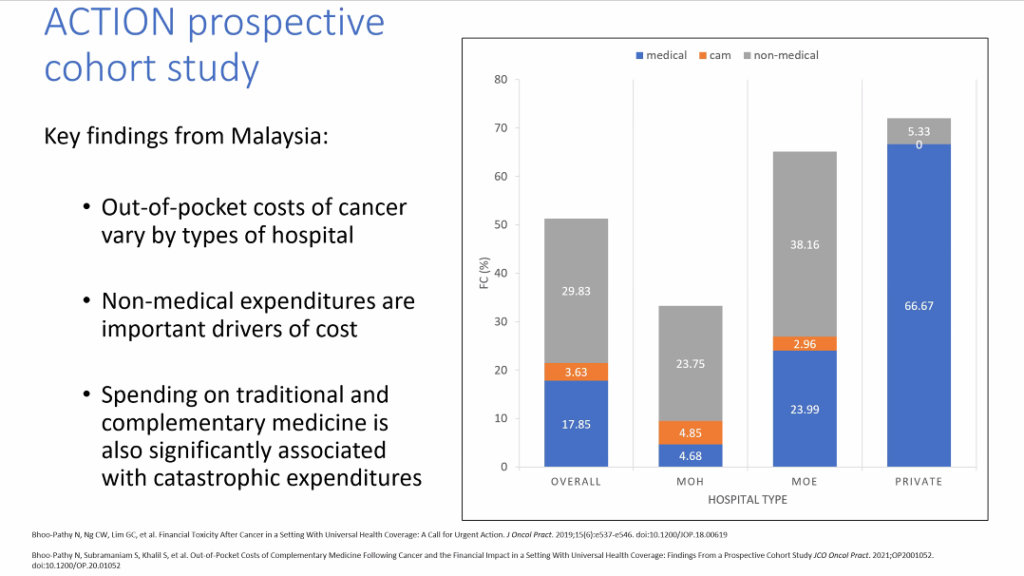

According to a study by Dr Nirmala, medical spending for cancer at private hospitals can hit over 66 per cent of out-of-pocket costs, compared to 24 per cent and 4.7 per cent at Ministry of Higher Education (MOHE) and MOH hospitals, respectively.

“One of the short-term solutions that we can choose to address, choose to invest in the coming years is financial navigation following a cancer diagnosis.

“We know from our prior study in Malaysia that cancer households have a lot of issues — they struggle with earning and employment, have debts and asset management issues, a lot of them are struggling, they have loans to pay, they have credit cards and so on.

“And there are also savings in cancer households where, after a while, they do not have savings anymore. That’s the thing about cancer families is they look well, they live in a proper house, they have a car, and people think they are fine but they are medically impoverished.

“What does it mean? It means following the diagnosis of cancer, their family income looks okay, but the family has actually fallen below the poverty line and nobody notices, and the problem is these families are usually not flagged for help,” Dr Nirmala said.

She said financial navigation can help to identify these sorts of families and those who are too shy to ask for help and try to navigate them by providing counselling and financial support, among others.