KUALA LUMPUR, Nov 14 — Malaysians are willing to bear some of their cancer treatment expenses instead of solely relying on the public health care system, a survey showed.

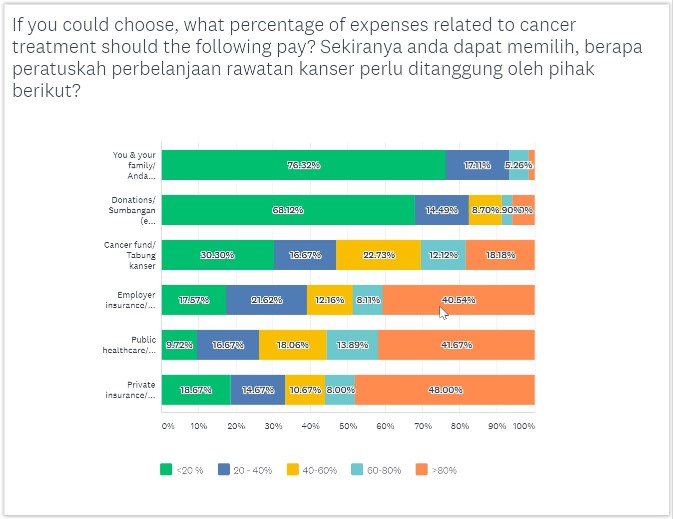

The survey by the Galen Centre for Health & Social Policy revealed that 76 per cent of respondents agreed that they or their family could fork out less than 20 per cent of total cancer treatment cost, followed by 17 per cent who were fine with themselves or their family bearing 20 to 40 per cent of cancer treatment expenses. About 5 per cent even said they or their family should pay 60 to 80 per cent of their cancer treatment expenditure.

Almost half of respondents, or 48 per cent, said private insurance should cover most, or above 80 per cent, of one’s cancer treatment expenses.

This was followed by 42 per cent of respondents who believed that public health care should bear over 80 per cent of the cost of cancer treatments.

Some 41 per cent of respondents said employer insurance should cover more than 80 per cent of their cancer-related costs.

About 18 per cent of respondents wanted a cancer fund to bear over 80 per cent of their cancer treatment expenditure.

National Cancer Society of Malaysia (NCSM) medical director Dr M. Murallitharan told a recent forum on advanced breast cancer organised by the Galen Centre that a copayment system — in which a patient pays a fixed out-of-pocket amount, with the remaining balance covered by insurance, public health care, or other parties — depended on the price of various drugs.

“Ideally, patient pays nothing. But we all know in reality, there has to be a percentage worked out. To be honest, the percentage will vary drug to drug,” Dr Murallitharan said.

“If it’s a RM5,000 drug, the copayment can be higher. If it’s RM30,000, can you come up with the same amount?” he questioned. “There needs to be a ceiling in terms of the total amount that will vary in terms of percentage.”

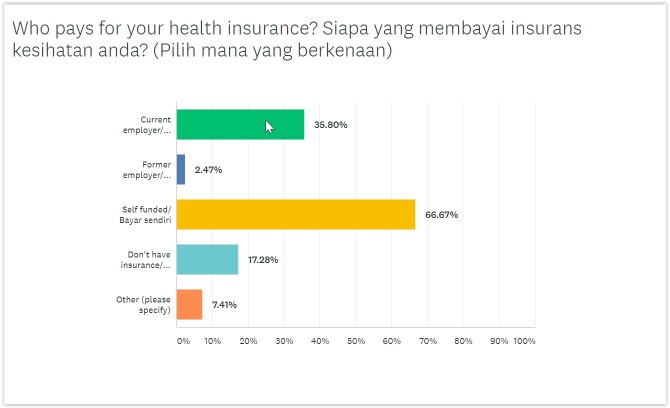

Galen’s survey revealed that 75 per cent of respondents had health insurance, while 24 per cent did not. About two-thirds, or 67 per cent, had their own health insurance, compared to 36 per cent who relied on health insurance provided by their employer.

About 17 per cent of respondents are currently living with cancer. Disturbingly, a third of respondents said a lack of money prevented them from going to the doctor or seeking treatment in the past one year.

Pantai Hospital consultant clinical oncologist Dr Mastura Md Yusof told the forum that during her previous job at Universiti Malaya, middle class cancer patients who truly benefited from a treatment were referred to the National Cancer Council Malaysia (Makna), where for an RM5,000 drug for example, payment was split between Makna paying RM3,000 and the patient covering the remaining RM2,000.

“For me, the M40 patients are the ones that we need to help in getting how they do co-payment,” she said, referring to the middle 40 per cent (M40) of income earners.

Beacon International Specialist Centre consultant clinical oncologist and medical director Dr Mohamed Ibrahim Wahid said his hospital has allocated funds under its corporate social responsibility programmes to help the middle and lower-income groups gain access to chemotherapy, radiotherapy and targeted therapy.

He said the Targeted Therapy Welfare Fund for Breast Cancer is a co-payment programme between Beacon Hospital, Roche Malaysia and the patients.

“The program is to reduce the financial burden of breast cancer patients by enabling them to gain access to targeted therapy. Patients are only required to pay RM2,500 per cycle for trastuzumab treatment, which is a fraction of the normal charges,” he said.

Galen chief executive Azrul Mohd Khalib said setting up a national cancer drugs fund to finance new treatments unavailable in public hospitals could be more sustainable if it was extended to the middle class on a copayment basis.

“Discussion now is very much on the B40 (bottom 40 per cent), but there is some room to look at how we can come up with solutions for M40, like copayments or an insurance model,” he said.

Galen’s online survey on how one pays for cancer treatment, which was launched last September 19, involved 142 respondents.